(CNN)It’s already home to the world’s tallest buildings, biggest shopping malls and largest man-made islands.

Read more: http://www.cnn.com/2016/09/01/travel/dubai-largest-indoor-theme-park/index.html

(CNN)It’s already home to the world’s tallest buildings, biggest shopping malls and largest man-made islands.

Read more: http://www.cnn.com/2016/09/01/travel/dubai-largest-indoor-theme-park/index.html

A shopper takes a seat during the ‘slow shopping’ service.

LONDON Shopping isn’t necessarily the most relaxing experience. But one UK supermarket will be slowing down the pace for two hours each day to help elderly customers and people with disabilities.

Sainsburys in Gosforth, Newcastle upon Tyne, is trialling a new concept called ‘slow shopping’, tailored to accommodate the needs of these two populations.

Slow shopping will be run at the store every Tuesday from 1pm to 3pm. People using the service will be greeted at the store’s entrance, where a Sainsbury’s employee can help them with their shopping.

Chairs will also be placed at the end of aisles to help people who struggle to stand for the duration of their shopping trip. The store’s help desks will also be serving samples of cakes, biscuits and fruit to shoppers.

The idea was spearheaded by local resident Katherine Vero, who found it challenging to go shopping with her mother, who had dementia. After her mother passed away, Vero was inspired to create a slow-shopping service.

My mum used to love shopping, but as her dementia developed it became increasingly difficult and stressful for us both,” said Vero in a statement.

“But I didnt want her to stop going out and become isolated. I wondered if there was a way to help us enjoy shopping.”

According to research carried out by Alzheimers Society, 850,000 people in the UK are living with dementia and 80 percent of people with the condition say shopping is their favourite activity.

The experience of deputy store manager Scott McMahon of helping his elderly parent while shopping opened him up to the approach by Vero.

“When my father developed cancer, I saw how hard he found shopping, yet he still wanted to go to maintain his independence, so when Katherine approached me about trialling slow shopping, I was keen to help,” he said in a statement.

Sainsbury’s isn’t the only store to adapt to its customers’ needs. Earlier this year, a supermarket in Manchester launched a ‘quiet hour’ for autistic shoppers.

With the slow-shopping trial in full swing, Vero is hoping the service will be rolled out to stores nationwide.

Read more: http://mashable.com/2016/08/30/slow-shopping-sainsburys/

Here come the fashbots, and this time they might actually be useful.

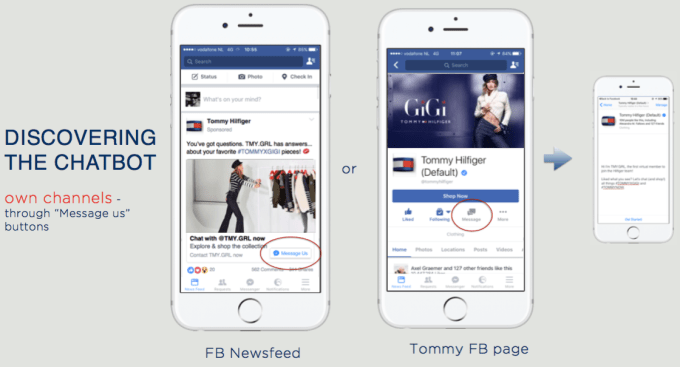

Facebooks seemingly half-baked chatbot platform soured many on the potential of conversation user interfaces. The first bots built by outside developers back in April were clumsy and more trouble than just using a website. So Facebooks Creative Shop is getting involved, working with bot creator Msg.ai and the Tommy Hilfiger fashion brand to make a flagship chatbot worthy to point to.

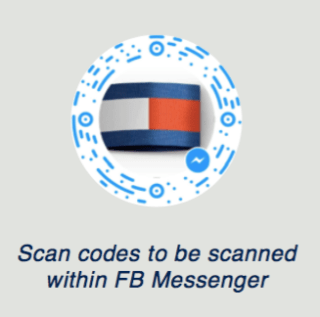

The TMY.GRL A.I. Messenger Bot will promote todays debut of Tommys capsule fashion line for supermodel and social media star Gigi Hadid. People can discover it by tapping the message button on Tommys Facebook page or posts, opening a shortlink URL or scanning its Messenger QR code.

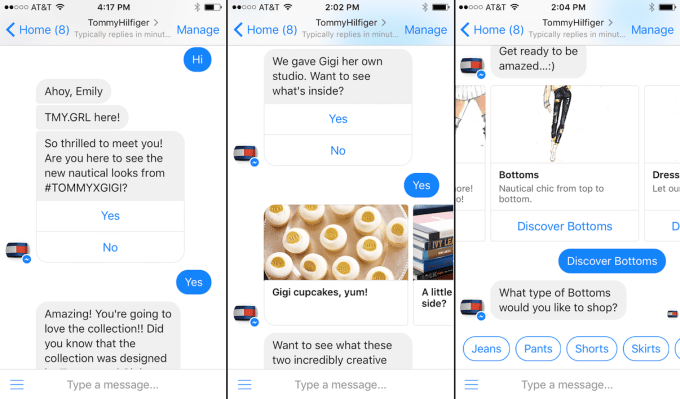

Through the bot, fashionistas can type questions or select pre-made queries to learn about Gigi, see behind-the-scenes content from the collections runway show event and, most importantly, shop for items from the nautical-themed clothing line.

Facebook still hasnt built a native checkout and payment flow into its Messenger bot platform. Shoppers will be linked out to Tommy Hilfigers website to put in their credit card details and confirm purchases. While that might give brands a deeper sense of control over the experience, it likely also reduces conversion rates as leaving Messenger gives them a chance to get distracted or reconsider buying something. Its something Facebook will hopefully build soon.

Iasked why the company is diving into the unproven world of bots, Tommy Hilfiger himself told me Were really focused on going directly to the consumer. We are obviously distributed in our own stores and in department stores, but going directlyto the consumer is really part of the motive and the future of the omni-channel process.

Puneet Mehta, CEO of Msg.ai, explains that consumer goods companies are attracted to bots because of the relationship aspect, not just sales. If they can create a memorable, interactive experience with their brand instead of just one-way marketing, customers will keep coming back. Thats why Facebooks marketing experts from its Creative Shop, which typically help out advertisers, got their hands dirty on developing this bot.

How did a 31-year-old company come up with the idea for a chatbot? Hilfiger tells me it started with a conversation I had with Sheryl Sandberg of Facebook. We talked about innovative ways to enhance the shopping experience. Were always a bit ahead of the curve.

Chasing new technologies hasnt always panned out. While Tommy Hilfigers Instagram and Snapchat strategies have been a success, 25 years ago it unsuccessfully tried to build touch-screen vending machines. Hilfiger explains that We had lots of trials and tribulations with that. The credit card system was working, the touch-screen heated up.

But now he feels that by relying on a dependable company like Facebook, theres less to worry about and more to gain as customersembrace new ways to shop.

Tommy Hilfiger CMO Avery Baker tells me that one of the things thats always been important in fashion is customer service and the experience in a store. TheTMY.GRL A.I. Messenger Bot will try to answer peoples questions and offer a more immersive, responsive feel than shoppers usually get online.

Tommy Hilfiger CMO Avery Baker tells me that one of the things thats always been important in fashion is customer service and the experience in a store. TheTMY.GRL A.I. Messenger Bot will try to answer peoples questions and offer a more immersive, responsive feel than shoppers usually get online.

The bot will try to capture some of the personality of talking to Gigi herself, while remaining transparent that theres not a human on the other end. No one wants to feel like theyre being spoken to by the corporate animal, Baker admits.

Fashion still seems like an unlikely candidate for chatbot success. People cant touch or try on the clothes, and the bot doesnt know enough about the users style to make smart recommendations about which items they might prefer.

But Hilfiger believes this brand-specific bot could perform better than multi-brand retail shopping bots like Spring, which launched with the Messenger bot platform and was quickly proven confusing and unconvincing.

Tommy Hilfiger (center)

I think if youre an established brand and the consumer is familiar with the brand, they have confidence that that certain cotton or cashmere or denim is the quality that would be acceptable, that they would be confident that the fit would be okay, Hilfiger concludes. Theres a lot of different reasons why people shop online. Now they can receive shipments, try on items, and send back what they dont accept. They dont necessarily need to touch and feel.

At the very least, Tommy Hilfiger could use the campaign to lure people into messaging their bot first. Thats critical, since Facebook Messenger only lets brands message people whove already pinged them. Getting conversations started is essentially the new version of getting people to Like your Facebook Page. Better to build an audience early than get left behind.

Read more: https://techcrunch.com/2016/09/09/botty-hilfiger/

Ever wanted to be locked in a shopping mall when you were a kid? Well, now you can LIVE in one if you’re based in Rhode Island. The Arcade providence, America’s first indoor shopping mall that was build in 1828, has been repurposed into a residential structure with 48 low-cost micro-lofts since it fell into decline in the late 20th century. The mall was transformed at a cost of $7 million by Northeast Collaborative Architects

Starting at $550 a month, residents can rent a one-bedroom unit from 225-800 sq. ft. Each apartment contains a kitchen, full bath with shower, built-in beds, seating and storage. There are no stoves in the units as they are designed for the people who lead busy lifestyles but the tenants can eat at freshly designed restaurants on the ground floor and enjoy vibrant evenings in a shared lounge. There’s also a shared laundry facility and a bike storage room as well as parking garage across the street. Would you live in such an apartment?

Image copyright PA

Image copyright PA

Some very big changes are now in the pipeline for the way people use their bank accounts and the way banks charge their customers.

The aim is to help people save money by encouraging them to change their banks, especially if they are likely to go overdrawn.

The plans come from the Competition and Markets Authority, which has the power to enforce its proposals.

They are the result of its two-year investigation.

Image copyright PA

Image copyright PA

The big idea is that something must be done to break the inertia of the UK banking public.

Just 3% of individuals and 4% of businesses switch their banks in any one year.

The CMA has already come to the conclusion that there is not enough competition to pressurise the banks into offering significantly better or cheaper services than their rivals.

In effect the big five banks – RBS, Barclays, HSBC, Lloyds and Santander – plus the Nationwide building society have their own huge, but largely captive, markets.

So the aim is to make it easier for people to switch banks and accounts, and to encourage them to save money by finding a better deal.

“The older and larger banks, which still account for the large majority of the retail banking market, do not have to work hard enough to win and retain customers and it is difficult for new and smaller providers to attract customers,” the CMA says.

The other big issue is one that has dogged the industry and its customers for many years – the ability of banks to charge more or less what they like if you go overdrawn without permission.

In 2009, the Office of Fair Trading (now part of the CMA) failed completely in a legal challenge which would have overthrown the right of banks to set their own charges as they saw fit.

Now the CMA is ordering the banks to set their own monthly cash limits – a monthly maximum charge – on just how much they can charge if you go into an unauthorised overdraft – going into the red without asking your bank in advance.

Image copyright PA

Image copyright PA

Of course that doesn’t go as far as a regulator being allowed to set a monthly limit on overdraft fees and charges.

But the fact there will be some sort of stated cash limit will make things clearer.

“Many personal customers, in particular overdraft users, could make significant savings by switching to a different current account,” says the CMA.

That particular change should happen by September next year.

To encourage customers to switch or shop around, the CMA is ordering the banking industry to embrace the idea of Open Banking.

That means the financial technology industry is being invited to develop a computer application which will let bank customers run all their bank accounts, including moving money between them, even if they have several accounts spread around different banks.

Image copyright CMA

Image copyright CMAAt the moment the increasingly popular bank apps, which are issued by banks to their own customers for use on mobile phones, operate that bank’s accounts only.

This new, all-purpose, banking app should be able, the CMA says, to let customers upload all their banking details so that “authorised intermediaries”, such as price comparison services, will be able to tell them where the best accounts and services are to suit the way they typically save and spend.

The CMA hopes that this will encourage customers to move money around, either to avoid upcoming overdraft charges, or to gain higher interest on more generous accounts.

Image copyright Reuters

Image copyright Reuters

There are quite a few other proposals, for instance:

The CMA has spent the past two years investigating the banking industry.

Its final report, published today, is just the latest in a very long line of official inquiries into the banking industry that have been held over the past 20 years or so.

But now the CMA’s plans have been finalised and published, they have various implementation dates ranging from the beginning of 2017 to the autumn of 2018.

Read more: http://www.bbc.co.uk/news/business-37023481

A Pokmon Go gym inside the Colonie Center mall in Albany.

With the Pokmon Go fever still shaking half the world, there’s bound to be plenty of trainers at any crowded place, and businesses can either fight it or embrace it.

The Colonie Center mall in Albany has decided to make the best of the situation. As seen on Reddit, the mall built a real life Pokmon Go arena for players.

With little more than a large Pok Ball on the floor, a few cardboard posters and team flags posted overhead, the “gym” is little more than a marketing gimmick. But it’s a smart one. There’s bound to be plenty of Pokmon Go players there at any time (as proven by this Imgur gallery of the same spot), so offering these customers something extra is likely a good idea.

The mall is also organizing Pokmon Go events and giveaways, boasting “3 on-site Pokestops and plenty of Pokmon loose throughout the center.”

This is one of many examples in which the megapopular augmented reality game influenced actual reality. It saved an ice cream shop in Anacortes, Washington from going out of business, and a churros shop in Westminster, California added a Pikachu-shaped churro to draw in customers.

Afrinvest (West Africa) Limited, has announced the appointment of Elkin Pianim as a Director of the firm while Michael Chu’di Ejekam has been named a Director for its broker-dealer subsidiary, Afrinvest Securities Limited (ASL).

A Ghanaian national, Pianim’s appointment, the firm stated, further reflects the pan-African outlook of Afrinvest, which also has Ms. Fatumata Soukouna, a Liberian national on the board of ASL and Dr. Fidelis Nde-Che, a Cameroonian, as Chairman of its Board of Directors.

Pianim has over 25 years experience in the financial services sector, and has worked on several landmark projects across the United States, United Kingdom, Zimbabwe and Ghana. He is currently Founder and Partner at Serengeti Capital Partners Limited – an Accra-Headquartered financial services group engaged in consultancy and asset management – and his areas of expertise include consumer goods, natural resources, media and technology.

Also, Ejekam, has a proven track record of full cycle retail investment and development including site origination, equity investment, planning approvals, development management, tenant leasing, asset management and exit of the largest retail malls in Nigeria, Ghana, and the broader West African market.

As Director of Real Estate for West Africa at Actis – a $7.5bn private equity firm, which is the most active retail developer in Sub Saharan Africa – Ejekam originated over $700m in retail projects. These include the $130m Jabi Lake Mall Abuja project; $100m Ikeja City Mall Lagos project; Heritage Place, Nigeria’s first green certified commercial building; and the Accra Mall.

Ejekam also has significant experience in international real estate with a United States private real estate investment and development firm with interests in $2bn of real estate assets. He was previously a Wall Street Investment Banker at Merrill lynch in New York, and participated in $3bn of acquisition, LBO financings, IPO and leverage loans. See original posting here.

As a thought leader in Nigeria’s retail revolution, Michael Chu’di Ejekam watches the sector with a keen eye. As of late, many supermarket giants have turned their attention to Africa, hoping to become established and take advantage of the blossoming market. Out of the top 100 markets, Africa and the Middle East accounted for just 12% back in 2012, but by 2013, the number jumped to 15%, and by 2015, the regions were home to 16.2%. In this article, the Michael Chu’di Ejekam Blog will examine several huge supermarket chains that have decided to center on Africa for growth, and explain why they’ve decided to do it.

At a recent summit in Cape Town, Wal-Mart CEO, Doug McMillon spoke about his overall goals for the company. “So sometimes people say Walmart is not really a growth company anymore. I want to say: Well, if we layer on $50 to $60 billion, would that count, in three years?” While Wal-Mart and its various subsidiaries are active on a global scale, McMillon says that they plan to put a broad focus on Sub-Saharan Africa. “It’s not only South Africa,” he said. “The whole region has something to offer.”

“By any metric, this is the best time to be in Africa,” explained Richard Brasher, CEO of Pick n pay, at the same consumer goods forum. “You can’t hope to control Africa or anything that happens in it, but what you can do is learn to adapt.” The company operates in Botswana, Lesotho, Mauritius, Mozambique, South Africa, Swaziland, and Zambia. Brasher said that one of the keys to success is recognizing that consumers in different countries have unique needs and preferences, and that businesses must adapt to them. The company’s present goal is to expand into Nigeria, but with a mix of both small and large shops to suit the needs of individual communities. His conviction unwavering, “We have ambitious plans for this continent, and we believe there’s a bright future,” Brasher added.

Self-dubbed as the “world’s largest voluntary retail chain,” SPAR has been very active in Africa for a number of years. The company opened its first Cameroon store near the end of last year and plans to continue growing its footprint in Africa in the coming years. SPAR recently ranked seventh on the list of growing retailers in Africa, after seeing more than a 10% increase over the course of a year. It also boasted the fourth-greatest sales in the region.

With the growing middle class and increasing urbanization, consumers are beginning to appreciate a more formal shopping environment. The population is also expected to double by 2050, reaching more than 2 billion people. As the market and need for more shops continues to boom throughout Africa, it will undoubtedly prove a wise a fruitful decision for these retailers to lay down roots now.

Take a moment to bookmark the Michael Chu’di Ejekam Blog now, so you’ll always have access to the latest info on the retail market in Africa, as well as related data and events.

Michael Chudi Ejekam is known for his work in the retail development sector throughout all of Africa. He has had a hand in numerous projects, often with a focus on Sub-Saharan Africa and his motherland of Nigeria. AT Kearney recently published its African Retail Development Index and rated countries based on various aspects, such as market attractiveness, country risk, market saturation, and time pressure, to determine which ones were the most desirable for retail development. Which ones came out on top? You’ll find the answers below, in this Michael Chudi Ejekam blog.

The prior report listed Gabon as number five, but the recent increase in growth helped it earn the top spot this time around. According to the report, Gabon has the most stable middle-class, and one of the highest per-capita income levels of any Sub-Saharan nation, which sits at around $21,000. Moreover, newcomers to the market don’t face serious struggles due to heavy competition because it’s just now beginning to blossom.

For similar reasons, Botswana climbed from number eight to number two on the list this year. The country has a very diverse economy, drawing revenue from mining, agriculture, and tourism. It’s a natural place for retailers to head to, and many of the big players in retail have become well-established already. Choppies, for example, has more than 70 locations there. This makes it more difficult for a newcomer to get established, though companies with a unique proposition or product still do well and the market continues to grow.

GDP growth makes Angola a very attractive place to do business. In these terms, it’s one of the fastest growing areas, with a 7% annual increase. However, it is still small (approximately 1/8 the size of Nigeria) and the middle-class population is nearly non-existent. Businesses that do well in Angola recognize this, and tend to cater to only the affluent Angolans or the very budget-conscious consumers.

Despite economic struggles, Nigeria remains a powerhouse for retail development. The population is massive, plus the middle-class is large and growing. Many citizens still favor local shops and small outlets, but the increase in urbanization is changing this as well. Numerous malls have been constructed and big companies like Shoprite have put down roots. Companies that do very well right now are catering to the loyalty of Nigerians, and are using locally-sourced goods whenever possible.

These four countries beat out all others, including South Africa, in terms of desirability for retail development. As time passes, we’re sure to see great things emerge from these markets, and positive results from those who enter them with a sound business plan.

For the latest business information regarding Nigeria and all of Africa, be sure to bookmark the Michael Chudi Ejekam Blog today. We’ll be adding more articles on a regular basis, so follow along and catch the latest news and info here.